Retailers Add Lockers to Capitalize on Online Sales

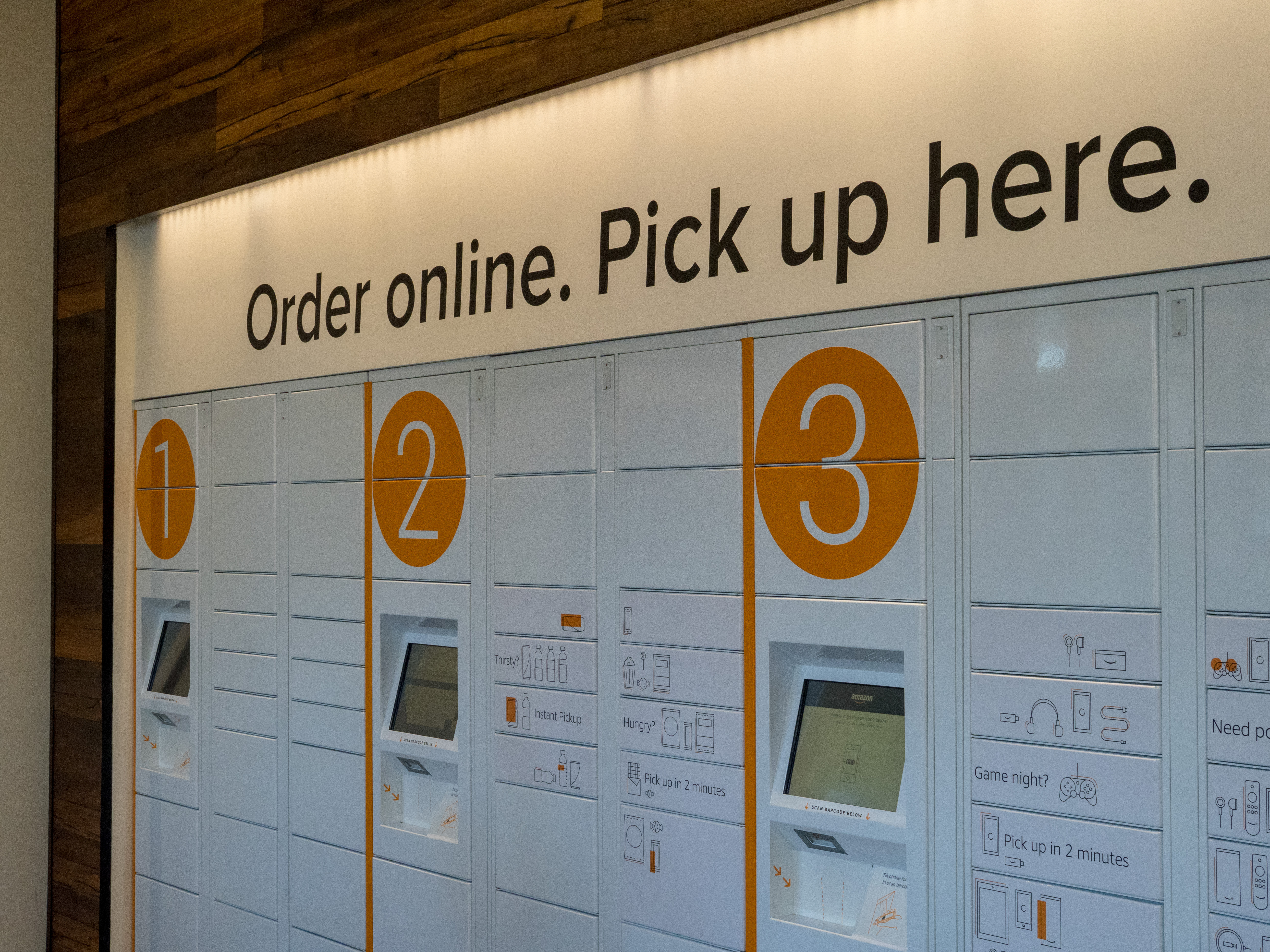

One of the latest trends in online sales is actually taking place in person. Online order pickup lockers are being installed in physical locations, something Amazon has been doing for a while now. The latest company to do this is do-it-yourself superstar retailer Home Depot, which, as Bisnow reports, has begun installation of their own pickup lockers at many locations.

The lockers, which are designed to let customers order online and then come in to pick up their items without having to request employee assistance, “The lockers allow us to simplify that process by providing customers with the convenience of self-service and time savings,” Home Depot spokesperson Lana Johnston told USA Today.

Home Depot joins other major companies such as Wal-Mart in doing this. Bentonville, Arkansas-based Wal-Mart last year pushed its Pickup Towers system in which the 16-foot-tall cylinders are available to customers seeking their online purchases. Even purchases made online in-store can be retrieved through these Pickup Towers.

These moves by major companies underscore the importance of investing money and effort into competing with e-commerce. Home Depot, for its part, has committed to sock $1.2 billion over the next five years into this endeavor. Moreover, Home Depot plans to add approximately 170 distribution centers nationwide by early next decade with a stated goal of hitting nine-tenths of the U.S. population in a day or less.

As compared to 2016, 2017 showed a 21 percent increase in online sales at Home Depot. Extrapolate this out and you might naturally – and correctly — assume that the effort is kicking in nicely.

“Ten years ago, people thought two-day shipping seemed really fast,” Amazon Prime Now head Stephenie Landry told writer Kela Ivoyne of Recode.net. “Now we think that two-hour shipping and one-hour shipping will be the standard.”

Ivoyne, an expert in the field who has run similar on-demand systems, cites U.S. Department of Commerce statistics showing that online sales hit nearly $400 billion — $394.86 billion, to be exact – in 2016, a more than 15 percent increase over the previous year.

“This has created a problem, one I experienced firsthand as an on-demand courier: e-commerce is growing so fast delivery infrastructure can’t keep up,” Ivoyne wrote. “This has led to inefficiencies known as the ‘Last Mile’ issue, which has amounted to significant financial losses for couriers and retailers alike. Couriers have lost billions from delivery delays and repeat delivery attempts, and e-commerce retailers lose nearly 1 percent of all revenues due to stolen packages and ‘Friendly Fraud’.” The latter is also known as chargeback fraud, when the customer charges an item to his or her credit card, only to dispute the charges after receiving the goods.

Here’s where the brick-and-mortar hybrid with online services may well come home to roost. It addresses these issues neatly and in ways that add layers of security as well as efficiency. We’ll see, however, how they manage to benefit the bottom line.